Well we’re finally here — the end of 2020! Let’s all breathe a collective sigh of relief.

I don’t think anyone will be sad to see this year go. But for me, as difficult as this year was, there were still some very positive things I want to acknowledge and celebrate. As I took a look back last year and the year before, I want to take a retrospective look at some of the things I accomplished in 2020.

Perhaps one of the biggest ironies is that the year really started to pick up around September and was a mad dash until the end of December. In that time, I recorded the bulk of this year’s podcast guest spots, so you never know when good things are gonna happen!

Before I dig into all the things I did do, though, I want to take a moment to acknowledge something that didn’t happen. For the first time in 5 years, I opted not to publish a new list of “100 Awesome Independent Album and EP Releases You Probably Missed” for 2020. There were any number of reasons that I chose (not) to do this; partly because of the Covid-19 pandemic, partly because of different projects I worked on and the time commitments associated with them, and partly because my heart may possibly have not been totally in it. Sometimes we have things we need to take a step back from, and this year my “100 Independent Albums” list was one of those things.

Music is still core to my identity and brand though, and isn’t going anywhere; if you want a taste of the list, though, here’s 2019’s list, which itself includes links to all the prior ones. I hope to have the musical fire back in me in 2021, so here’s to looking forward to some phenomenal albums and EP’s next year!

So, with that, here are a few of my biggest highlights for the snafu that was 2020.

January

My girlfriend took me to IKEA for the first time!

Though I didn’t get my annual pic with Arlan this year, on a similar note I got to congratulate my friend Bryan Landers for joining Backstage Capital as its new partner! So that’s something. Always be celebrating others.

Was so humbled to be able to literally voice my support for my friend & ally Espree Devora on her “Women in Tech” podcast. This was a great way to start my “recording spots” for the year. (She’s since become the icon for the new Clubhouse app!). 🎙️

Started this year out with a bang! My article — “There’s Life After Failure” — was shared by my friend Bobby Umar into his network and ended up getting featured on the front page of an aggregate blog. 😮

February

I got my first real taste of going viral on LinkedIn. It wouldn’t be the last time (more on that below!).

Visited Denver, Colorado for the first time with this beautiful girl! ✈️

Denver has amazing food!

And mountains! 🏔️

Started the “I Am Vow” graffiti thing again… (I might need to write an entire article just on this alone…stay tuned…) 😉

Went skiing for the first time! I did…ok. 🎿

And Boulder has cool socks!

Back in Atlanta, had a fantastic meeting with the brilliant David Lightburn of Atlanta Ventures and the Atlanta Tech Village down at ATV (before Covid!). Looking forward to our next chat in the beginning of 2021!

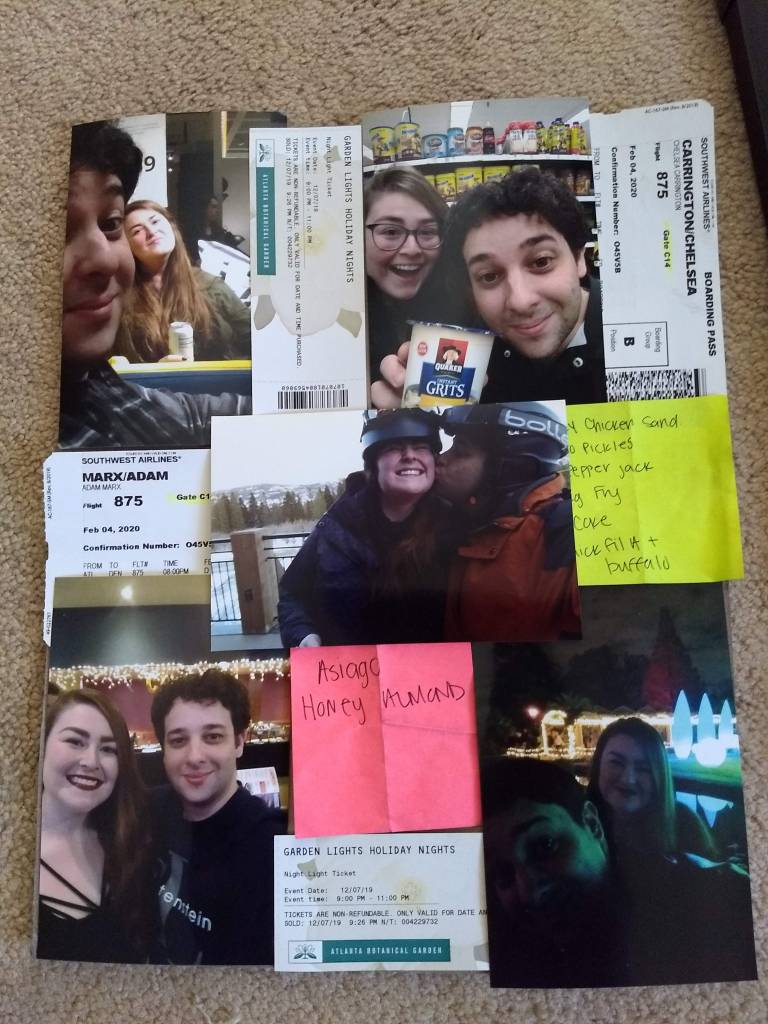

Wonderful Valentine’s Day with this one — made her a collage. ❤️

I had my first call of the year with Aly Merritt. Little did I know what that zoom call would lead to!

Aly mentioned that she was working on a project and could use some help leading it. It was secret, though, for the time being.

The project?

Track captain for the Tech/Fintech track for TechStars’ inaugural Atlanta Startup Week! More on that later!

March

Covid-19 hit and we all began to understand that life was going to change pretty drastically for a long while.

I recognized that I may have missed my calling as a VC-inspired parody writer. Aileen Lee graciously put up with my ridiculous humor ha! 😂

Had my first virtual coffee (via Cuppa, thanks KP!) with Whit Anderson. Whit and I would spend the rest of the year building out an awesome dialogue around startups, no-code, networking, and the Atlanta tech scene!

Got retweeted by Gary V. to 2M people — my notifications subsequently blew up. 😱📈

Started celebrating Shabbat! 🕯️🕯️

The beginning of a consistent calendar of calls with Mubs — things started cooking. Mubs and I started having consistent chats — this would lead to exciting things later in the year.

The first of a year’s worth of awesome calls with my friend Dale Dupree, the master of the Sales Rebellion.

Published an article looking at why one of my posts went viral on LinkedIn. It seems that this would continue to be a theme throughout the rest of the year… 📈📈

April

I made my second #AdamMarxParodyProductions creation — Hunter Walk continues to put up with my humor as well. 😂

Chelsea made the best challah French toast!

Love April 19th — always a special day since Mom and Dad have the same birthday! 🎂

I started to really run my LinkedIn experiment on new strategies — with legitimate viral success! 🤔📈

Had an amazing opening call with my new friend Dr. Julie Gurner. We discussed the opportunities on LinkedIn, how to build great relationships, and possible projects together. Saw this pop up in my Twitter feed later that night and was just so humbled by the kind words! (She continues to tweet similar things and I’m so bowled over by the positivity every time she does!).

Did my first webinar, thanks to my LinkedIn friend Emmanuel Ndifor. We talked about how current students on campus could lean into social media tools to build out their networks and prepare for virtual job interviews when campuses and career centers remained closed. Discussing networking, branding, & how to build influential relationships from scratch was especially critical to helping students navigate the first steps of the job market during a time as difficult as the pandemic. 🎦

Great call with Wayne Sutton and so humbled by his kind words!

May

My brother turned 21 and I felt old. 🎂

Then I launched Branded Background (include link) with Mubs on Product Hunt! Out of a series of discussions that we had over zoom grew the idea that we could apply branding to all the zoom calls that people were having (and that were multiplying by the day!). I wrote about the reasoning for building it here. So we went heads-down for a week or so and kicked it out the door. It ended up doing 334 votes on Product Hunt!

We got some pretty cool traction and feedback from the Twitter and PH crowd that day! 😃🙌

Got retweeted by Product Hunt!

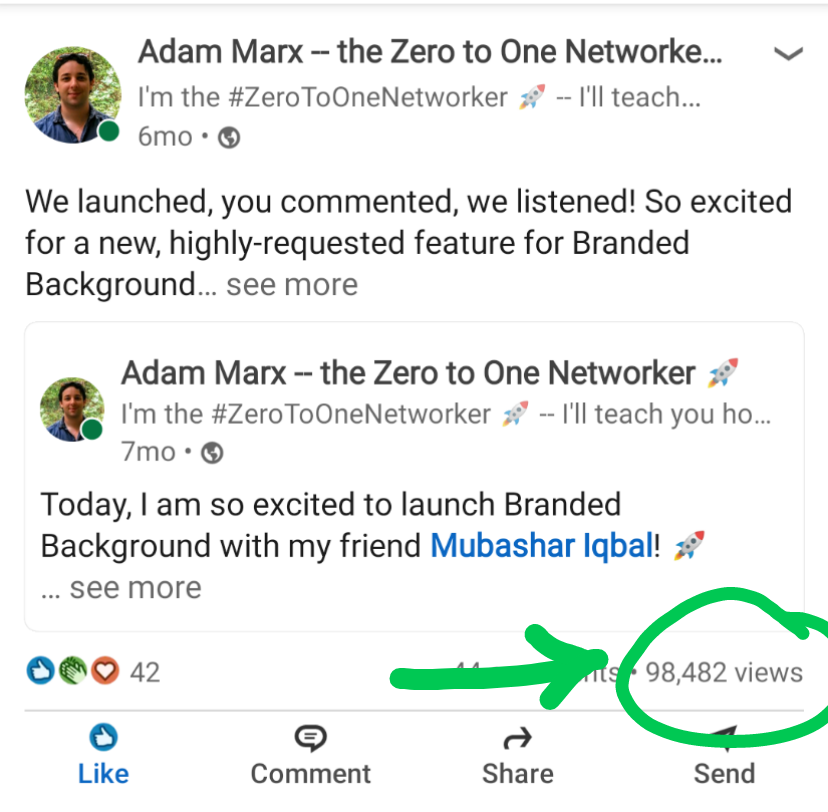

What really surprised us, though, was the response we got on it from the LinkedIn community.

Our final stats for the end of the day were pretty good for my first launch on Product Hunt. (We continued to rack up about another 150 votes after the initial launch day). 😉👏

Chelsea is part Cherokee, so I took her to New Echota here in Georgia — the last Cherokee capital east of the Mississippi River. Heritage is important.

Mom bought a new house and helped her move in! It’s now become our home away from home. 🏠

June

June was a little thin since we did our best to basically stay inside and be safe. But…moved into a new apartment! Still waiting to have our official housewarming party, but the new place is looking pretty good.

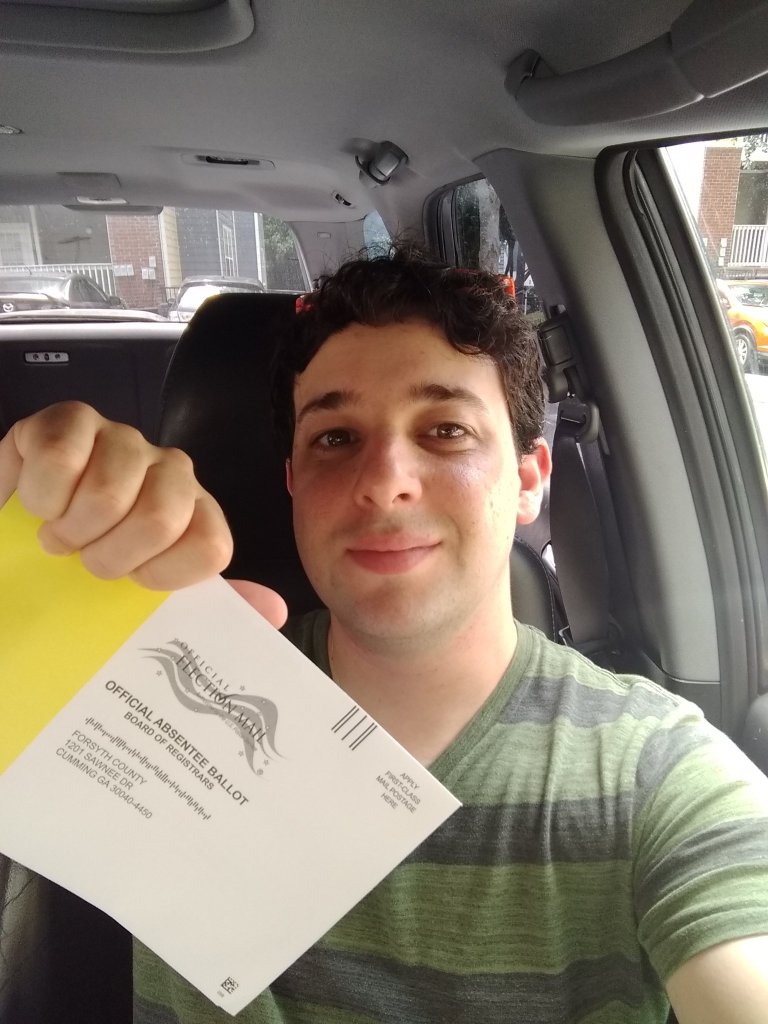

Cast my early vote in the primaries for my friend Jon Ossoff. 🗳️

Then road trip to Tulsa, OK to visit my Chelsea’s mom! We had the puppy in the back and he loves car rides. (Don’t worry, we were safe and socially distanced the whole time). 🚗

Found out that Alabama can’t decide if it allows dogs or not…

Had my first Sonic Drive-In burger ever! 🍔

Went to Joe’s Sno Shack — apparently it’s a Tulsa staple and it’s pretty damn good!

July

Headed down to the beach in Florida for a week away! Again, believe me that we observed social distancing pretty strictly; we drove, rented a house, brought our own food, didn’t eat out and stayed far away from everyone on the secluded beach. Was nice to have a few days outside Atlanta. 🏖️

Called on my alma mater Brandeis University to stand up for what was right. They answered in kind.

Here’s the piece I wrote about the whole experience.

Got an awesome gift from my friends Niv and Nick over at Shrug Capital!

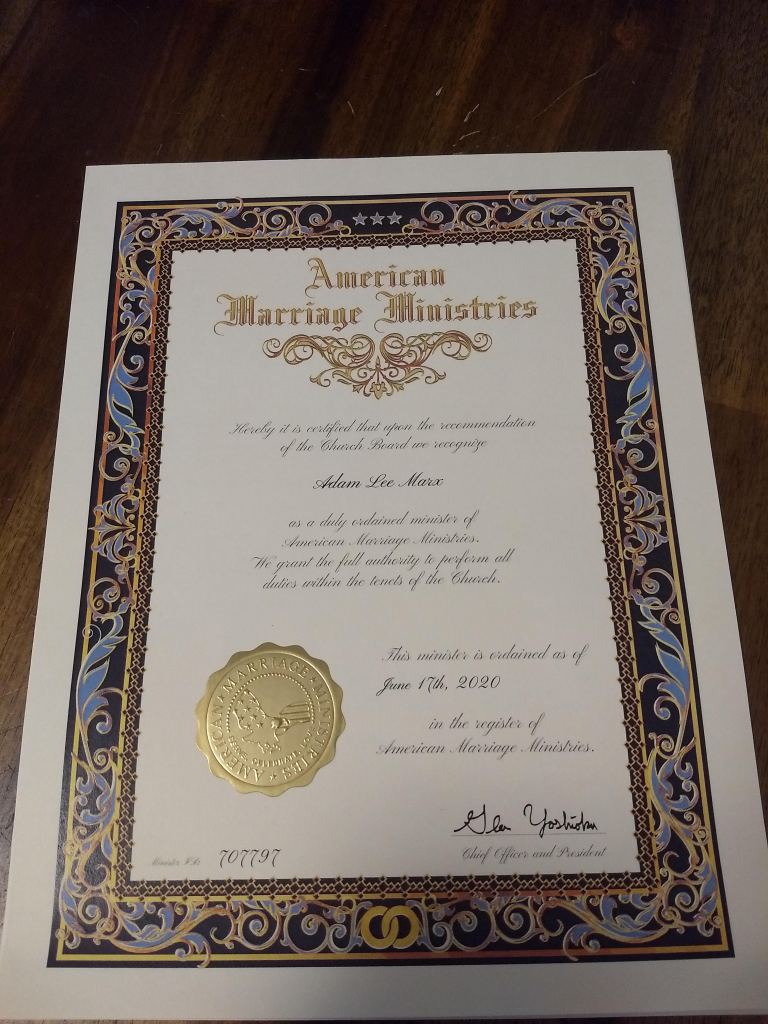

I got ordained…in Ohio at least. I had to reassure my grandma there’s no religious context to it and I’m still a nice Jewish boy. 🤣

My friend JB sent me a copy of Arlan Hamilton’s new book!

I was super humbled to guest on Olga Kirshenbaum’s “9 Minutes of Creative Wisdom” podcast to talk about the intersection of money, creativity, networking, & branding! 🎙️

The episode would drop later in the year.

I was listed on LinkedIn influencer Derick Mildred’s list of “120 Rising Stars & Upcoming Influencers to Watch on LinkedIn”! 😮😁🙌

Here’s a link to Derick’s original LinkedIn post!

August

We had a major storm here in Atlanta, but I earned the name I shall be buried with:

Adam the Branch Slayer! 🌳

Helped my parents launch their official company website! ⚖️

Guested on the “Digital Introverts” podcast with Godwin Chan. recording should be out early next year! 🎙️

Celebrated this gorgeous girl’s birthday! The pets were there too. 🎂

September

Had a great time guesting on Bob Clark’s show “The OnFire B2B Podcast” to talk about networking and branding in the B2B space! 🎙️

It was one of the highlights of my year to sit down with LinkedIn super-influencer and my dear friend Rachel Beck on her podcast to discuss topics close to my heart like mental health, diversity, empathetic relationship-building, and my own Jewish identity. 😊🎙️

We broke the hour-long discussion up into multiple bits and I was thrilled to drop the first one just before the Jewish High Holidays this year.

Part 2

Part 3

October

Voted early on Day 1!

I finally decided it was time for a chance and a new image.

Celebrated one of the anniversaries I am lucky enough to celebrate with this wonderful girlfriend. It was one year ago October 19 that we met and the rest is pretty much history. ❤️

Recorded a LIVE guest spot on Simon Squibb’s show! Had a killer time talking networking, branding, core relationship cultivation techniques, and lending some of my expertise to a startup that live-pitched Simon and me! 🎙️

Was finally able to announce the work I had been doing with TechStars since Aly Merritt brought me on in February! 😃🙌

So proud of my brother for writing his first screenplay — and letting me read it! I had a few edits, but couldn’t put it down and read the whole thing in one night — yeah, it’s that good.

And if that wasn’t all, immensely proud of my parents for having their case picked up by FinLedger! Mary Ann Azevedo wrote a pretty amazing piece. 😮

The story was even the lead for that week in the FinLedger newsletter!

November

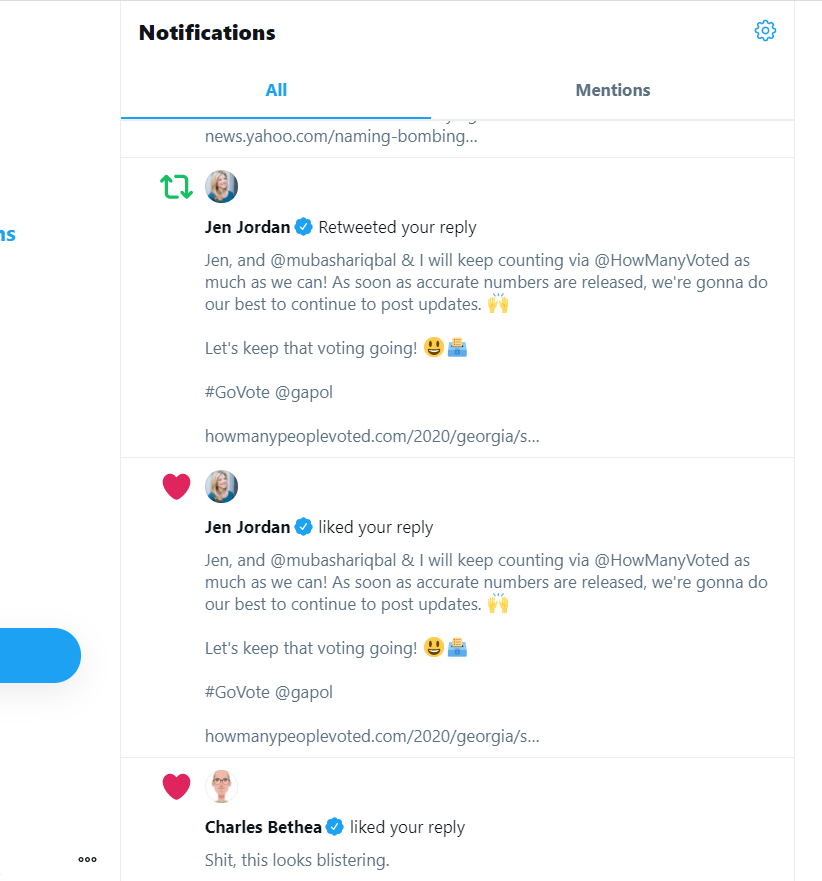

Joined my friend Mubs again for another launch — this time for the election! We launched HowManyPeopleVoted.com to try to keep track of the breakdown of officially counted votes in the 2020 U.S. general election. 🗳️

We started trending on Reddit! 😱

And then we got featured on the front page of Refdesk!

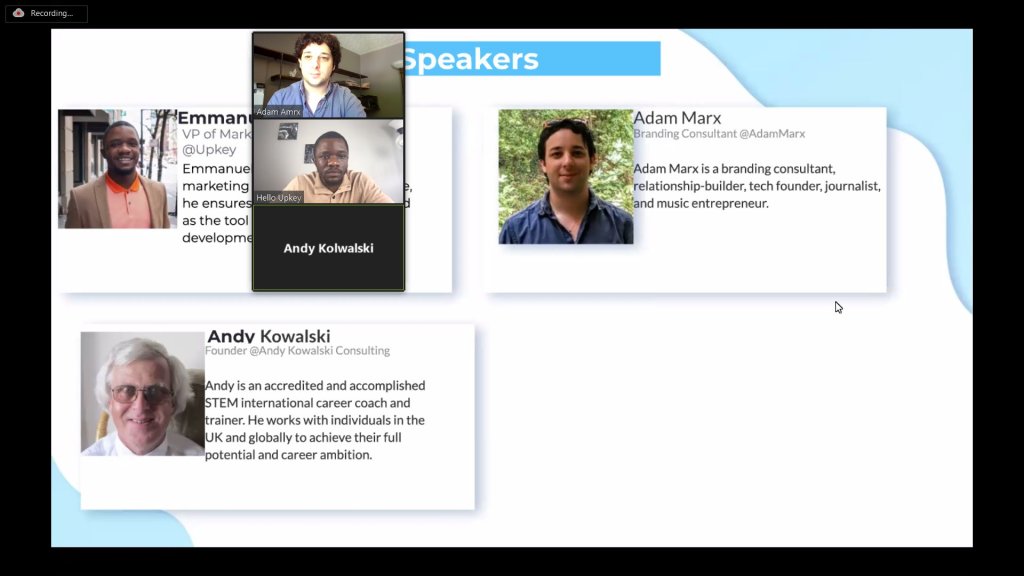

I was so immensely excited and humbled to work with TechStars on their inaugural Atlanta Startup Week! We ran it virtually from Nov. 9-13 and were able to pull together an amazing list of guest speakers for the Tech/Fintech track!

A couple highlights for me were seeing my mom speak on Day 1 about what it takes to have good company culture and the efforts that need to be made to keep it inclusive and respectful of everyone. Moderated by my friend Stefanie Jewett and also featuring my friend, LinkedIn influencer Elaine Jacques.

I was also able to lead my own panel and discussion, though the recording hasn’t been uploaded yet (I’ll update when it is!).

I had the pleasure of sitting down with LinkedIn influencer Cory Warfield, entrepreneur Jake Tital, and film-tech veteran Kate Atwood — all close friends of mine — to discuss what exactly it takes to build a magnetic and influential network from scratch. We drilled down into the nuances of networking, brand, what really works, and what really doesn’t, and what founders really should know about building their own networks.

And I wrapped up the week with a surprise guest spot during one of the last blocks for the event, a great talk between LinkedIn influencers Judi Fox and Dale Dupree — also people whom I’m truly inspired by — around branding, marketing, and how to build a persona that works.

My mom hung one of my paintings in her office. 🎨

And hung the other one in one of the main hallways.

I had a killer time guesting on Bob Sieger’s podcast “Coffee With Bob” after meeting him through my friend Rachel Beck. It’s true what they say: the more people you know, the more opportunities you see pop up! In fact, Bob had reached out to me after he heard my recording on Rachel’s show (as did others!), so I’m continually grateful to her for that opportunity. 🎙️

Bob and I connected immediately and it wouldn’t be our last time collaborating. 😉

December

Began December with a bang as I guested for the second time that week on a great cast where I could lend some value and expertise!

I had met Joey Womack through my work with TechStars on the Atlanta Startup Week (he’d also been a track captain and long been on a list of local “people to know” at the top of my list) and we had such a great conversation during the wrap-up captain meeting that he invited me to guest on his massive Goodie Nation #GivingTuesday live broadcast! 🎙️

We talked all about the best ways to build concrete relationships and I shared some of my own most unbelievable stories that Goodie Nation community members could really find actionable! He brought in so many talented guests to speak that he had to break it into two recordings lol! I guest on the first recording and come in around 5:23:15.

I came back again that week to do another video cast with my friend Bob on a very special holiday-themed live episode of “Coffee With Bob” and it was a blast meeting the other guests. Looking forward to catching up with them in the new year. 🎙️

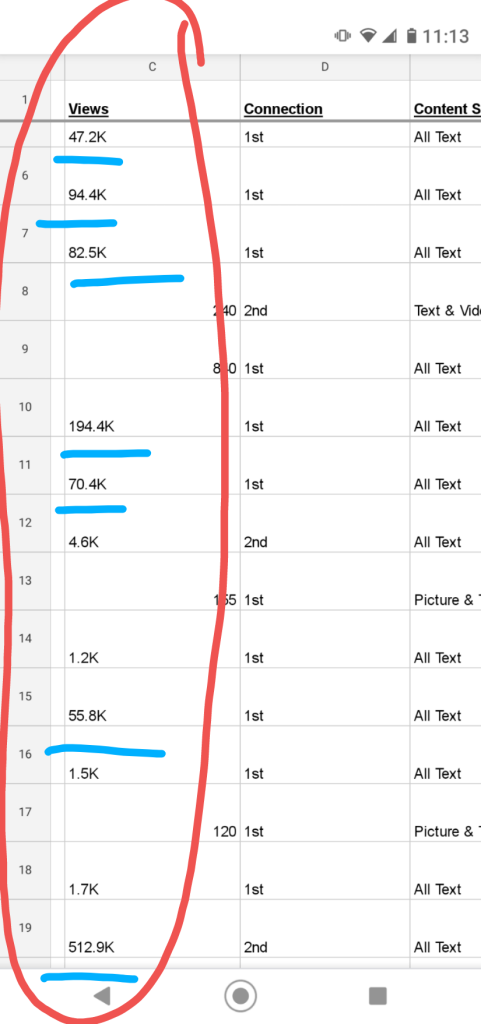

I published my article “How I Went Viral by Ignoring One of the ‘Rules’ of LinkedIn” on the LinkedIn experiment that I ran all through the spring time. 📈📈📈

In it, I described how I used certain tactics in particular, one often recommended against — in my LinkedIn strategy to rack up more than 1.6 million post views over just about 12-15 posts.

Mubs and I redesigned HowManyPeopleVoted.com for the Georgia Senate runoffs!

And it was retweeted by Georgia State Senator Jen Jordan! 😱🗳️🙌

I wrote about our decision to redesign it here. It’s important to stay involved and we knew this was a project worth continuing forward on.

Celebrated my sister’s 26th birthday! 🎂

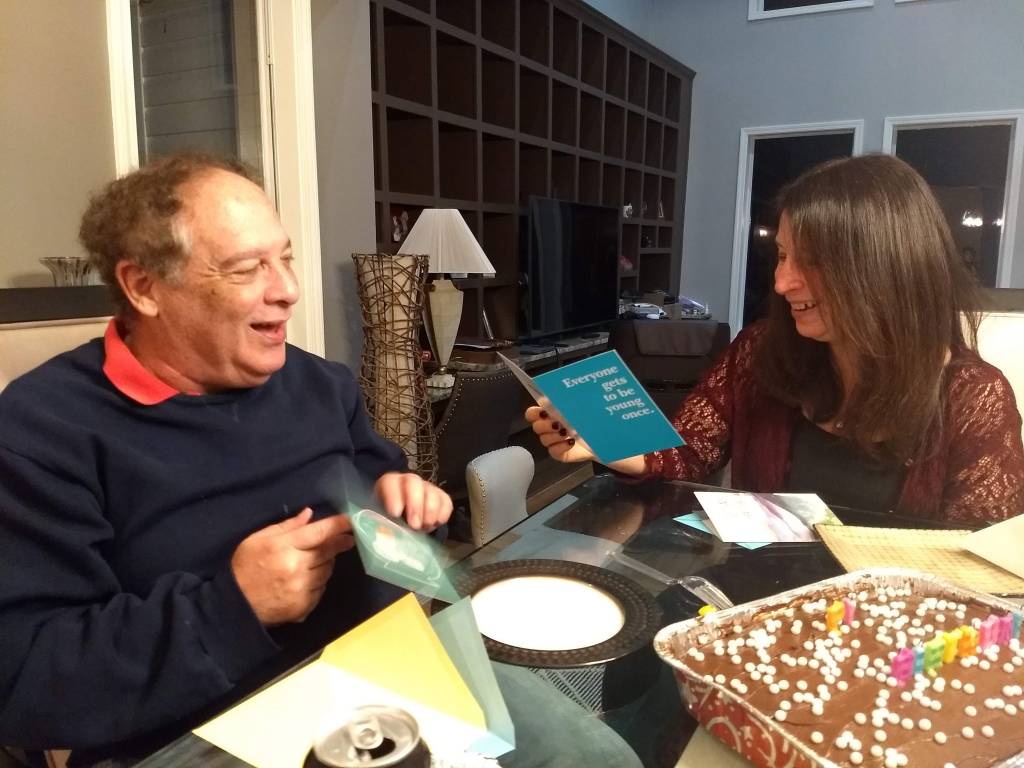

I turned 30. 🎂

Voted for the third time this year.

Had an awesome time guesting on the “Progressholics” podcast with Devesh Tilokani. 🎙️

Recorded my last guest podcast spot of 2020 with my friend & LinkedIn influencer Luke Williams on his “30 Conversations with Entrepreneurs” event and had an awesome time wrapping up the year discussing how people can begin or continue to build incredible networks in 2021. 🎙️

I’ll definitely be back for another chat on one of his casts!

Celebrated one year for the second night my girlfriend and I love to celebrate…which happens to also be my parents’ anniversary, funnily enough.

And this year they celebrated 40 years!

Took Chelsea to the Chattahoochee Nature Reserve on one of her break days to see some birds and plants. It was a great place to socially distance and she loves the outdoors!

It flurried a little in Atlanta. ❄️

One of my favorite bands Eve 6 liked one of my tweets — pretty good way to round out a tough year. 🎸

Reflecting on 2020

This was a hard year for everyone. There were a lot of challenges to overcome. But I’m grateful that at the very least I have people I love around me as I move into my 30s. Perhaps a little cliched, but that’s how I feel as this year draws to a close.

Even with this crazy pandemic, 2020 was a marathon year for me. I guested on numerous podcasts, launched multiple projects, and coordinated for a major tech event. I began building my brand around the Zero To One Networker persona and philosophy, and look forward to seeing that grow in the new year. On the personal, I formed wonderful memories with those closest to me.

As I said last year, no plan ever survives the battlefield. So while there were things I wanted to accomplish this year, I know they’re well on their way to happening next year. I’ve grown as a creator, builder, entrepreneur, and most importantly, as a person. As I move into a new decade of my life, I’m excited to see that continue!